THE MONEY MOMENT

Welcome to our blog, where we provide the insights and guidance you need to navigate your financial journey with confidence! At Infinite Heights, we focus on making all things money approachable and empowering. As a female-focused financial planning firm, we’re passionate about guiding women (and the men who love them) toward mastering their finances with confidence and clarity. Think of us as your personal financial guides, here to help you navigate the world of money, make informed decisions, and help you build a life that you love!

Venezuela: What’s Happening and What You Should Know

The recent detention of Venezuelan President Nicolás Maduro by U.S. authorities is a dramatic and unexpected geopolitical development. While humanitarian and regional stability concerns are front and center, it is reasonable for you to wonder what this might mean for markets, oil production, and broader global dynamics. History reminds us that events like this can create short-term volatility, but rarely change long-term market fundamentals.

2025 Market in Review: Strong Results in a Year Full of Headlines

2025 was a standout year for investors, delivering strong market performance despite a steady stream of headlines, policy developments, and economic uncertainty. This report breaks down what drove results across U.S. and global markets, bonds, currencies, and alternative assets, and highlights the key events that shaped the year. More importantly, it reinforces a timeless lesson: disciplined, long-term investing continues to work. As we look ahead to 2026, we explore what last year’s trends may mean for the opportunities and challenges to come.

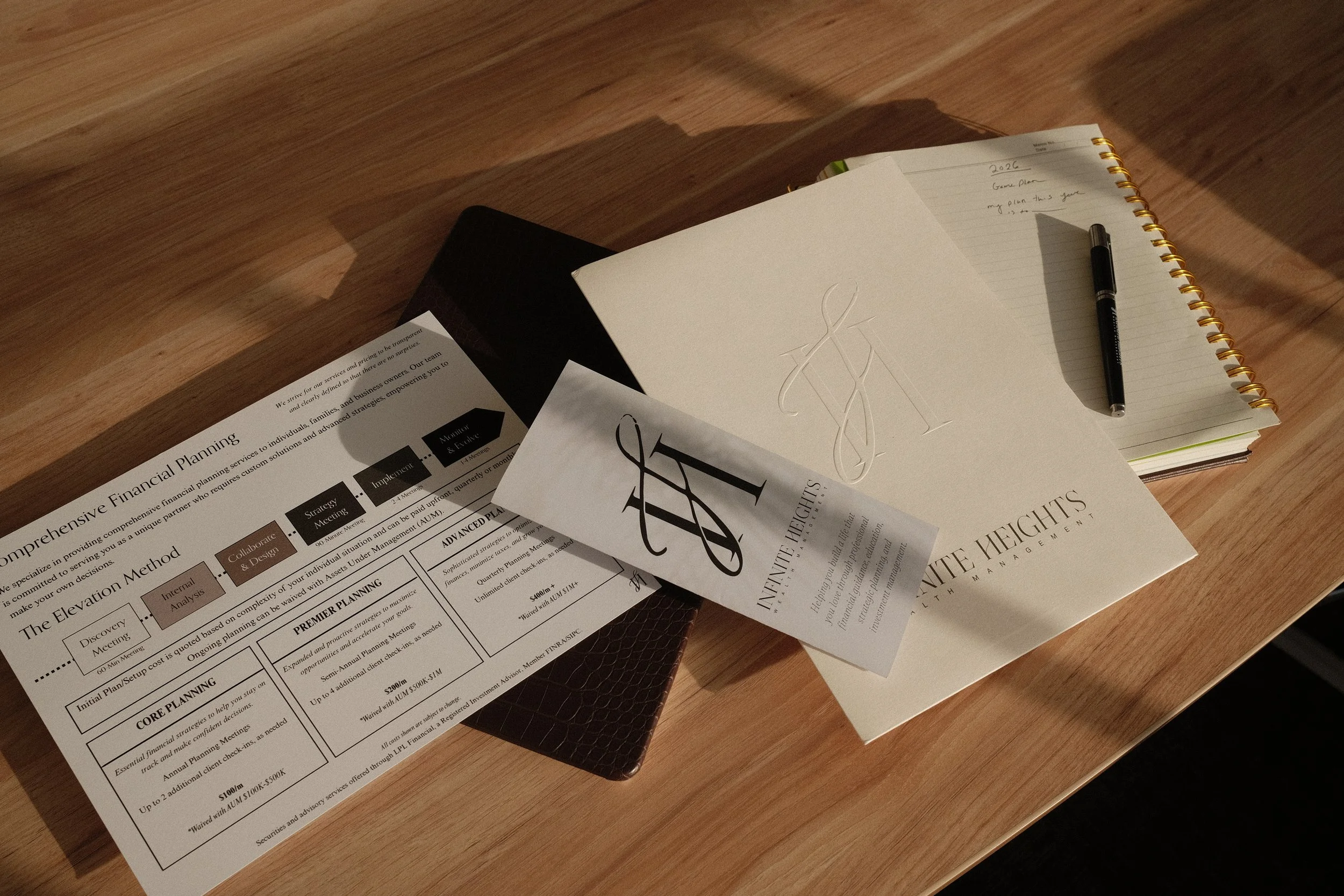

New Year, New Goals: Crafting a Business Plan for Success in 2026

The start of a new year is a natural moment to reflect, reset, and get intentional about where you are headed. Whether you are running a business, building something new, or leading a growing organization, clarity and direction matter. A thoughtful business plan helps you stay focused, measure progress, and make smarter decisions. At Infinite Heights Wealth Management, we believe in starting the year with purpose, vision, and a strategy you can actually execute.

2026 Market Outlook

Markets delivered strong returns in 2025, but headlines are already shifting toward what could come next. This outlook breaks down the key themes shaping 2026 and how we are positioning portfolios to stay resilient, diversified, and focused on long-term goals rather than short-term noise.

Finishing 2025 Strong:Treats for Your Future Self

December always tricks you into thinking you have more time than you do. Here's what still needs to happen before the 31st. Here's the truth: most of the big strategic moves we talked about in November? If you haven't handled them yet, you still have time. But that window is closing fast, and some deadlines are hard stops that can't be extended. So let's cut through the noise and focus on what actually matters in these final weeks.

Year-End Charitable Giving: Smart Strategies That Maximize Your Impact

As the holiday season unfolds, many of us find ourselves reflecting on what matters most, including how we can support the causes and communities we care about.

But here's the thing: thoughtful charitable planning isn't just about generosity. When done strategically, it can also strengthen your overall financial picture. The question isn't simply whether to give, but how to give in ways that maximize both your philanthropic impact and your financial goals.

November Market Recap: Navigating Uncertainty in AI and Federal Reserve Policy

Despite a swirl of headlines around AI spending, Federal Reserve policy, and the government shutdown, markets held their footing in November. This recap highlights the key themes and reminds investors why clarity, discipline, and a well-built plan are essential in times of uncertainty.

2026 Retirement Plan Limits: What the Mandatory Roth Catch-Up Means for Your Strategy

The mandatory Roth catch-up for high earners is the most significant structural change to retirement savings rules in recent years. It's not optional, it's not temporary, and it affects a substantial portion of retirement savers.

You need to plan for the tax impact in 2026, verify that your employer's plan is set up correctly, and ensure this fits into your broader retirement strategy.

What Investors Can Be Grateful For This Holiday Season

As we move into the holidays and wrap up another year of planning and progress, it is worth stepping back to take stock of the financial landscape that has supported your growth. Markets have been resilient, diversified portfolios have been rewarded, and long-term investors who stayed disciplined have benefited from a year of strong performance.

This is an ideal moment to reflect on what went well, reinforce the strategies that are working, and prepare for the opportunities ahead. Here is what stood out this year and why these developments matter for the future you are building.

Monthly Market Update for October

The stock market continued its strong performance in October despite uncertainty from a government shutdown and renewed trade tensions with China early in the month. Many major indices reached new all-time highs after recovering from a brief period of volatility. Bonds also contributed positively to portfolios as interest rates declined, fueled partly by the Federal Reserve's second consecutive rate cut.

Despite positive gains, the month was not without challenges. The ongoing government shutdown captured headlines and raised recession concerns, while a brief "tariff tantrum" over rare earth metals caused the largest single-day market decline since April. However, markets quickly recovered, reinforcing the importance of not overreacting to headlines. These market dynamics also pushed gold to a new record level, before pulling back toward the end of the month.

Trade War with China: The Latest Tariff Tantrum and Market Volatility

On Friday, markets experienced their largest one-day drop since April, triggered by renewed tensions between the U.S. and China over rare earth metals and potential tariffs. While headlines focused on the sudden sell-off, markets quickly stabilized as the White House softened its tone on trade.

For many investors, these quick swings can feel unsettling, especially after a period of relative calm. But beneath the surface, the story is much bigger than a single day’s decline.

What a Government Shutdown Really Means for Your Portfolio

As of this week, the federal government is still shut down following another budget standoff in Washington. It’s a familiar story, lawmakers couldn’t agree on funding before the October 1 deadline, and now parts of the government have gone dark until a deal is reached.

For many investors, the natural question is: How will this affect my portfolio?

The short answer: probably less than you think.

Quarterly Market Update for Q4 2025: Navigating Conflicting Signals

Markets reached record highs in the third quarter, powered by strong corporate earnings and investor enthusiasm for artificial intelligence. At the same time, the labor market has softened and the Federal Reserve has begun cutting rates in response. As we enter the final quarter of 2025, investors face mixed economic signals — but history reminds us that disciplined, diversified portfolios are built to weather every phase of the market cycle.

Staying Ahead of Inflation: Strategies for Investors

Anyone who lived through the high inflation years of the 1970s and 1980s or who remembers the post pandemic price spikes has seen how quickly costs can rise. Today inflation is more persistent than many expected. Concerns about tariffs potentially driving up consumer costs are back in the spotlight. At the same time the economy remains resilient with strong consumer spending, healthy employment, and solid corporate earnings.

Monthly Market Update for August 2025: Record Highs and Rate Cut Rumors

August was another strong month for the markets, with both stocks and bonds finishing higher. In fact, we saw record highs in several areas, even as headlines about tariffs, Federal Reserve policy, and tech valuations continued to stir uncertainty.

Markets dropped in the middle of the month because investors worried the Fed might keep interest rates high to fight inflation. Recent inflation reports showed that companies are starting to charge consumers more because of tariff costs. But markets bounced back when companies reported better earnings than expected and investors became more confident the Fed would lower rates in September.

The New Tax Bill is Here: How to Make it Work for You

On July 4 President Trump signed the One Big Beautiful Bill Act (OBBBA) into law. This legislation brings some of the biggest tax changes we have seen in years. While the headlines have focused on politics, what truly matters is how this bill affects your financial plan, your income, your business, and your long-term goals. Understanding the new law’s implications can help you make informed financial decisions and make the most out of the potential opportunities presented by the bill.

Monthly Market Update for July 2025: Record Highs, Tariff Tensions, and What It Means for Your Plan

July was a big month for the markets. The S&P 500 hit ten new all-time highs, fueled by strong corporate earnings, steady economic growth, and trade deals wrapped up before new tariffs kicked in. In the second half of the month, the index posted six consecutive record-setting days, bringing its total gain for the year to 7.8%. But as the month closed, the mood shifted. On July 31, a new tariff announcement raised concerns about potential price increases for consumers. At the same time, employment data showed the job market has cooled more than earlier reports suggested.

Is Social Security Going Away? What You Really Need to Know

Social Security isn’t going away, but it is changing. Whether you’re days or decades away from retirement, it’s never too early to understand how Social Security fits into your financial plan. To have perspective on the opportunities and risks, it's important to understand the program’s history, current challenges, and the strategies available to navigate what’s ahead.

Q2 2025 Market Recap: Equity Rally, Fed Policy, and Investment Takeaways

The second quarter of 2025 proved that even in a noisy environment—policy shifts, global tensions, market headlines—staying grounded in your long-term plan pays off. While April’s new tariffs and June’s Middle East conflict initially caused market jitters, both equity and bond markets finished strong. In fact, most major indexes hit new highs by quarter-end. Here’s what happened, why it matters, and what you can take away as a growth-minded investor.

Navigating Washington’s New Tax Laws: A Strategic Estate Planning Guide

As Washington state enacts major changes to both its estate and capital gains tax laws, high-earning individuals—especially business owners and women building multigenerational wealth—face a critical window for planning. With top estate tax rates rising to 35% and capital gains over $1 million now taxed at 9.9%, proactive strategy is no longer optional. This article breaks down what’s changing, why it matters, and what smart investors should be doing now to protect their legacy and take advantage of available opportunities before the rules shift again.