November Market Recap: Navigating Uncertainty in AI and Federal Reserve Policy

November brought a brief wave of volatility across the markets, touching equities, bonds, currencies, and digital assets. Even with that turbulence, most major benchmarks remain significantly positive for the year. Still, questions around artificial intelligence spending, Federal Reserve policy, and the delayed flow of economic data created an environment where it was easy to feel uncertain.

Moments like these are exactly why investors benefit from a long-term approach and a portfolio built with intention. When you have a plan rooted in your bigger vision, short-term pullbacks feel less like threats and more like normal parts of the journey.

What factors shaped November's market movements, and how should investors maintain clarity as the year draws to a close?

Primary Market and Economic Factors During November

The S&P 500 advanced modestly by 0.1% for the month, while the Dow Jones Industrial Average climbed 0.3%, and the Nasdaq dropped 1.5%. Through November, the S&P 500 has risen 16.4%, the Dow has increased 12.2%, and the Nasdaq has surged 21.0%.

The VIX, which tracks equity market volatility, closed at 16.35 after reaching an intra-month peak of 26.42.

The Bloomberg U.S. Aggregate Bond Index increased 0.6% during November and stands 7.5% higher year-to-date. The 10-year Treasury yield concluded November at 4.02%, having temporarily dipped below the 4% threshold.

Based on the MSCI EAFE Index, international developed markets rose 0.5% in U.S. dollar terms, whereas emerging markets declined 2.5% according to the MSCI EM Index. For the year through November, the MSCI EAFE Index has appreciated 24.3% and the MSCI EM Index 27.1%.

The U.S. dollar index finished at 99.46, momentarily surpassing the 100 mark.

Bitcoin underwent a substantial retreat of approximately 17% throughout November, closing at $91,176.

Gold prices finished the month at $4,218, remaining beneath October's record high of $4,336.

The September employment report, postponed by the government shutdown, revealed that 119,000 positions were added to payrolls while the unemployment rate edged up to 4.4% for that period. No October employment report will be released.

Risk Aversion Returned

During November, market participants temporarily retreated from riskier holdings including technology equities, high-yield debt instruments, digital currencies, and similar investments. This movement stemmed largely from doubts about the long-term viability of AI-related spending and recalibrated forecasts regarding Federal Reserve policy decisions. The S&P 500 has now experienced six drawdowns of 5% or greater this year, matching levels last seen in 2022 while remaining near historical norms. Several major asset categories recovered during the month's final sessions, with the S&P 500 finishing marginally higher.

Technology stocks connected to artificial intelligence endured their most challenging week since April. Worries about corporate expenditures and leverage, profitability metrics, and speculation about valuation excess contributed to price swings. Nevertheless, underlying business performance remained solid, with companies like Nvidia posting strong revenue and profit expansion in their third-quarter results. Certain equities, including members of the Magnificent 7, rallied following these announcements.

Digital currencies underwent a pronounced correction amid this risk-averse environment. Bitcoin tumbled more than 30% from its early October peak above $125,000, momentarily trading under $85,000 and erasing its year-to-date appreciation. Although investor adoption of digital currencies has expanded, such episodes illustrate that these and comparable assets can exhibit high speculative characteristics and cyclical volatility. Consequently, consistent risk oversight and appropriate portfolio construction remain essential considerations.

Fixed income markets advanced in November, supported in part by declining long-term rates as the 10-year Treasury yield again briefly dropped below 4%. This movement reflected updated expectations about government policy that could influence rates over extended periods. For the year through November, the Bloomberg U.S. Aggregate Bond Index has returned 7.5%, marking its strongest performance since 2020. This strength has contributed to balanced portfolio outcomes.

Government Shutdown Concluded but Economic Uncertainty Lingers

The 43-day federal shutdown finally ended, but funding only extends into January. That means political uncertainty will return soon.

The shutdown also delayed critical economic data, creating gaps that make it harder to read the true strength of the economy.

The Bureau of Labor Statistics published the delayed September employment report, initially scheduled for October release. Results indicated that job creation surpassed forecasts for September, recovering from summer weakness. Revised data, however, showed that 4,000 positions were eliminated in August, representing the second month of negative employment growth this year. The unemployment rate climbed to 4.4% in September, its highest reading since October 2021, though this figure remains modest from a historical perspective.

Because household and business surveys were suspended during October, a complete employment report for that month will not be issued. However, certain October data will appear alongside November's release on a delayed schedule.

What to Expect from the Federal Reserve

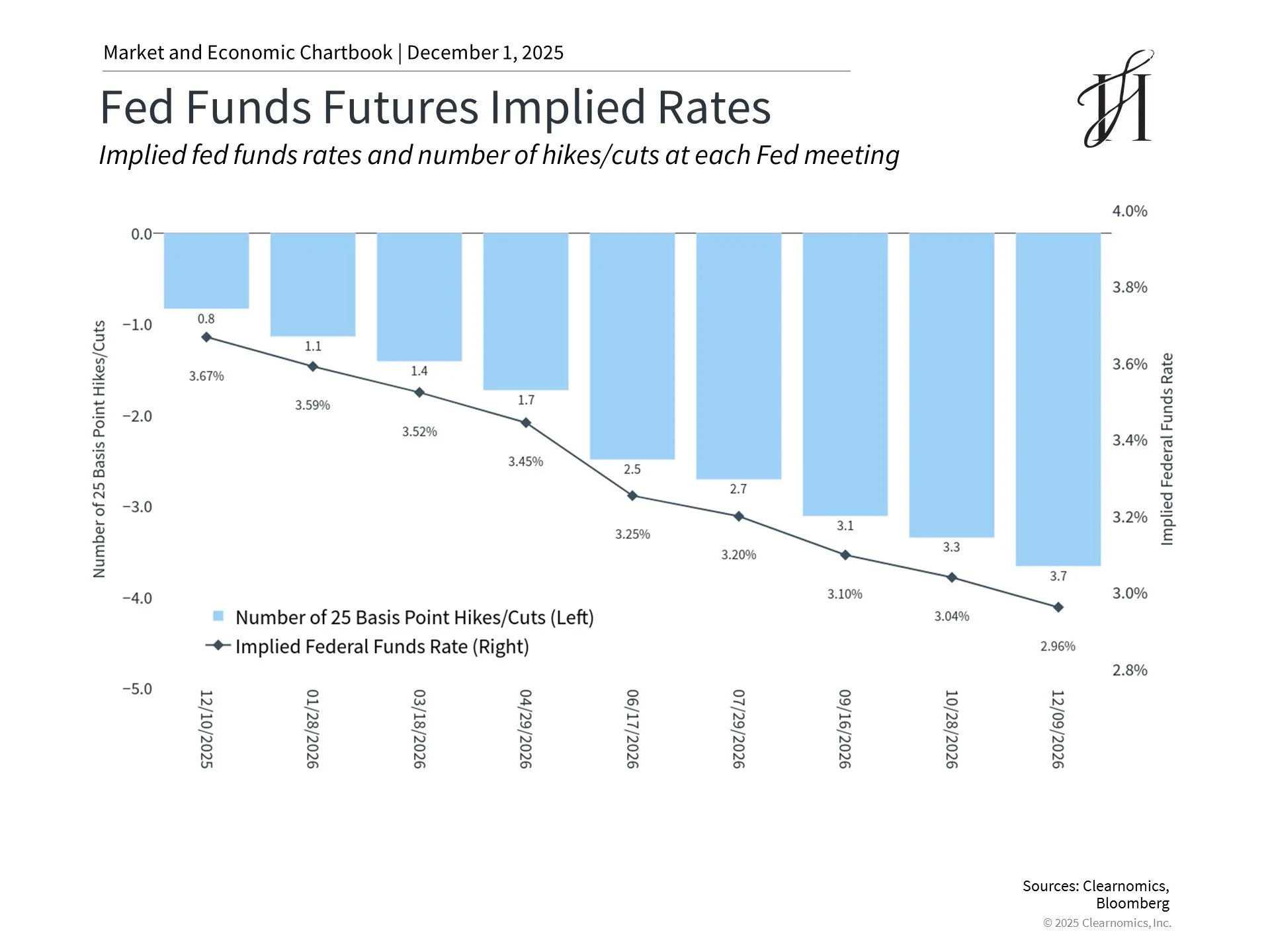

These reporting gaps mean the Federal Reserve will conduct its mid-December policy meeting with an incomplete economic assessment. The likelihood of a rate reduction at the upcoming meeting fluctuated significantly, with probabilities declining sharply in mid-November before recovering. Current market-derived forecasts suggest the Fed will reduce rates in December, followed by additional cuts in April or June 2026.

Additional economic indicators, including measures of consumer confidence, have also deteriorated. The University of Michigan's Index of Consumer Sentiment preliminary reading fell from 53.6 to 50.3 in November. This decline reflects persistent anxieties among Americans regarding employment stability, elevated prices, and their broader financial circumstances. Although many households face financial pressures, weak sentiment in recent years has not resulted in meaningful reductions in consumer spending or business revenues.

The bottom line?

November was another reminder that volatility is normal. Headlines will shift, data will be delayed, and markets will react. What matters most is staying anchored to a long-term plan and a portfolio designed to support your life, your goals, and the freedom you’re building.

If you have questions about any of these movements, or how they connect to your personal strategy, we’re here to talk through it with you.

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC.

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.