Trade War with China: The Latest Tariff Tantrum and Market Volatility

On Friday, markets experienced their largest one-day drop since April, triggered by renewed tensions between the U.S. and China over rare earth metals and potential tariffs. While headlines focused on the sudden sell-off, markets quickly stabilized as the White House softened its tone on trade.

For many investors, these quick swings can feel unsettling, especially after a period of relative calm. But beneath the surface, the story is much bigger than a single day’s decline.

The Bigger Picture: Strong Returns Amid Uncertainty

Despite periodic volatility, markets have been remarkably resilient this year. The S&P 500, Nasdaq, and Dow have all delivered double-digit gains, while the bond market, measured by the Bloomberg U.S. Aggregate Index, is up nearly 7%. Even more striking, international stocks have outpaced the U.S., with developed and emerging markets returning roughly 22% and 27%, respectively.

The takeaway? One bad day doesn’t erase a strong year. Markets have always rewarded patience over reaction.

What’s Driving the Headlines: Rare Earth Metals and Trade Policy

The latest market volatility was the result of new restrictions on the export of rare earth metals by China, which then led the White House to threaten an additional 100% tariff on Chinese goods on top of existing duties. This represents a continuation of the back-and-forth that has created uncertainty for investors and businesses all year. Fortunately, the White House has appeared to walk back these threats and indicated that there could be negotiations in the coming weeks.

What are rare earth metals and why have they been at the center of the tariff battle? Unlike many other goods and services that are imported by the U.S., rare earth metals are primarily produced by China. While these materials are not actually rare in geological terms, China has built significant mining and processing capabilities over several decades, surpassing all other countries. These materials are critical components in many high-tech devices including smartphones, electric vehicles, batteries, military systems, and advanced electronics.

For these reasons, rare earth metals represent one of China's greatest points of leverage with the U.S. and the rest of the world when it comes to trade and foreign policy. It's estimated that China currently controls approximately 70% of global rare earth production and nearly 90% of processing capacity, creating supply chain dependence for the rest of the world. The U.S. has stockpiles of rare earth metals and has issued executive orders to increase their production, but this will take time.

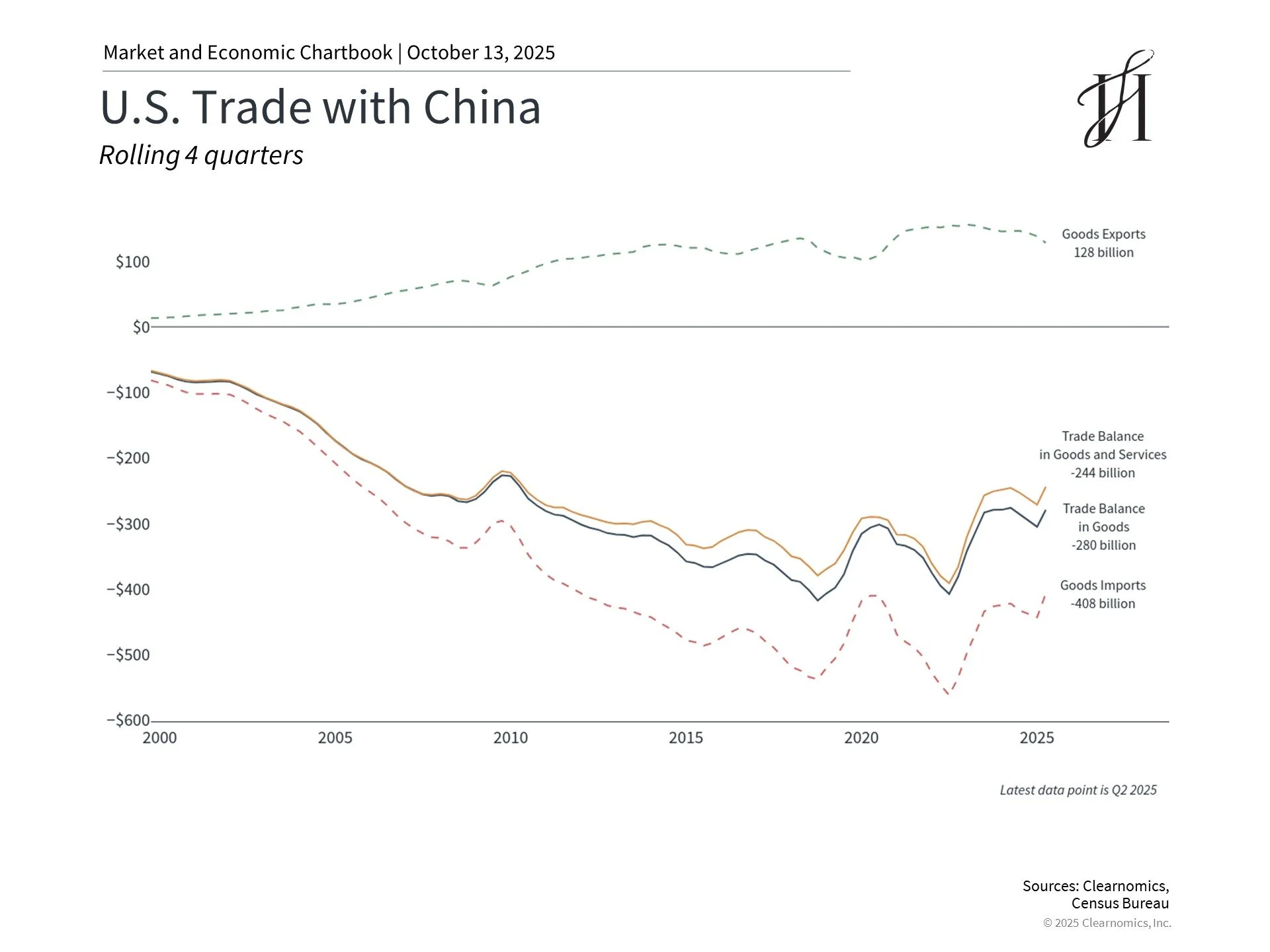

Negotiations over rare earth metals are only one component of the administration's trade policy with China. As shown in the chart above, the U.S. continues to run a significant trade deficit with China, and reducing this imbalance while encouraging domestic manufacturing has been one of the administration's political objectives.

The results so far have been mixed - while some manufacturing has returned to the United States and there have been announcements of new investments, supply chains can't shift overnight. The fact that the job market has weakened in recent months hasn't helped: as of the August employment report, manufacturing employment had declined by 78,000 jobs this year.

For investors, it's difficult to know if new tariff threats should be taken at face value, or are part of ongoing negotiations. This can lead to rapid shifts in sentiment and market behavior. For this reason, it’s important to not overreact to headlines, and let situations develop while focusing on the longer-term trends. Not only was this true during the first trade war in 2018 and 2019, but investors who overreacted earlier this year would have missed the swift market recovery.

The accompanying chart highlights the relationship between the VIX index, a measure of stock market volatility, and the subsequent one-year forward returns for the S&P 500. Historically, spikes in the VIX have often resulted in strong forward returns, since this is when many investors are fearful of entering the market, or sell at inopportune times. This shows how counterproductive it can be to overreact to market swings.

Market volatility tends to spike when uncertainty rises, whether it’s geopolitical risk or valuation concerns. Today’s market reflects both. Investors have questioned whether recent gains, particularly in technology and AI stocks, can continue at the same pace.

But history tells a reassuring story: periods of higher volatility often precede strong forward returns. When fear drives prices down, disciplined investors are positioned to benefit as markets recover.

Why Perspective Is Your Greatest Advantage

It’s easy to get swept up in daily headlines or market drops that make the news cycle. But true long-term investors know that volatility isn’t a signal to retreat, it’s part of the process. Staying invested through short-term uncertainty has historically been one of the best predictors of long-term success.

While the 2.7% decline on October 10 was the fourth worst day of the year for the S&P 500, it's important to maintain perspective here as well. The accompanying chart shows that market declines of 5% or more occur regularly for markets, even during positive years. While this year has felt volatile, the reality is that the number of pullbacks has been quite average when compared to market performance over the past 45 years. In fact, the market has defied expectations this year with the S&P 500 rising 31.5% from its April “Liberation Day” low, hitting over 30 new all-time highs so far this year.

The point is not that the market always goes up in a straight line, since it certainly does not. Instead, it’s that periods of market uncertainty are both normal and expected for markets, and investors should always be ready for short-term turbulence. Avoiding the tendency to worry about every new development that might derail the market is one of the keys to long-term financial success. At Infinite Heights, we view moments like these as opportunities to reaffirm your plan, not react to the noise. Your portfolio is built for resilience, balance, and growth over time, not for chasing or dodging the market’s latest move.

The Bottom Line

Trade tensions will ebb and flow. Headlines will come and go. But your financial success depends on maintaining focus through it all. Volatility may be uncomfortable, but it’s also a normal and expected part of investing —and often, the very environment that creates the next opportunity.

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC. Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.