What a Government Shutdown Really Means for Your Portfolio

As of this week, the federal government is still shut down following another budget standoff in Washington. It’s a familiar story, lawmakers couldn’t agree on funding before the October 1 deadline, and now parts of the government have gone dark until a deal is reached.

For many investors, the natural question is: How will this affect my portfolio?

The short answer: probably less than you think.

Markets have shown resilience during past shutdowns

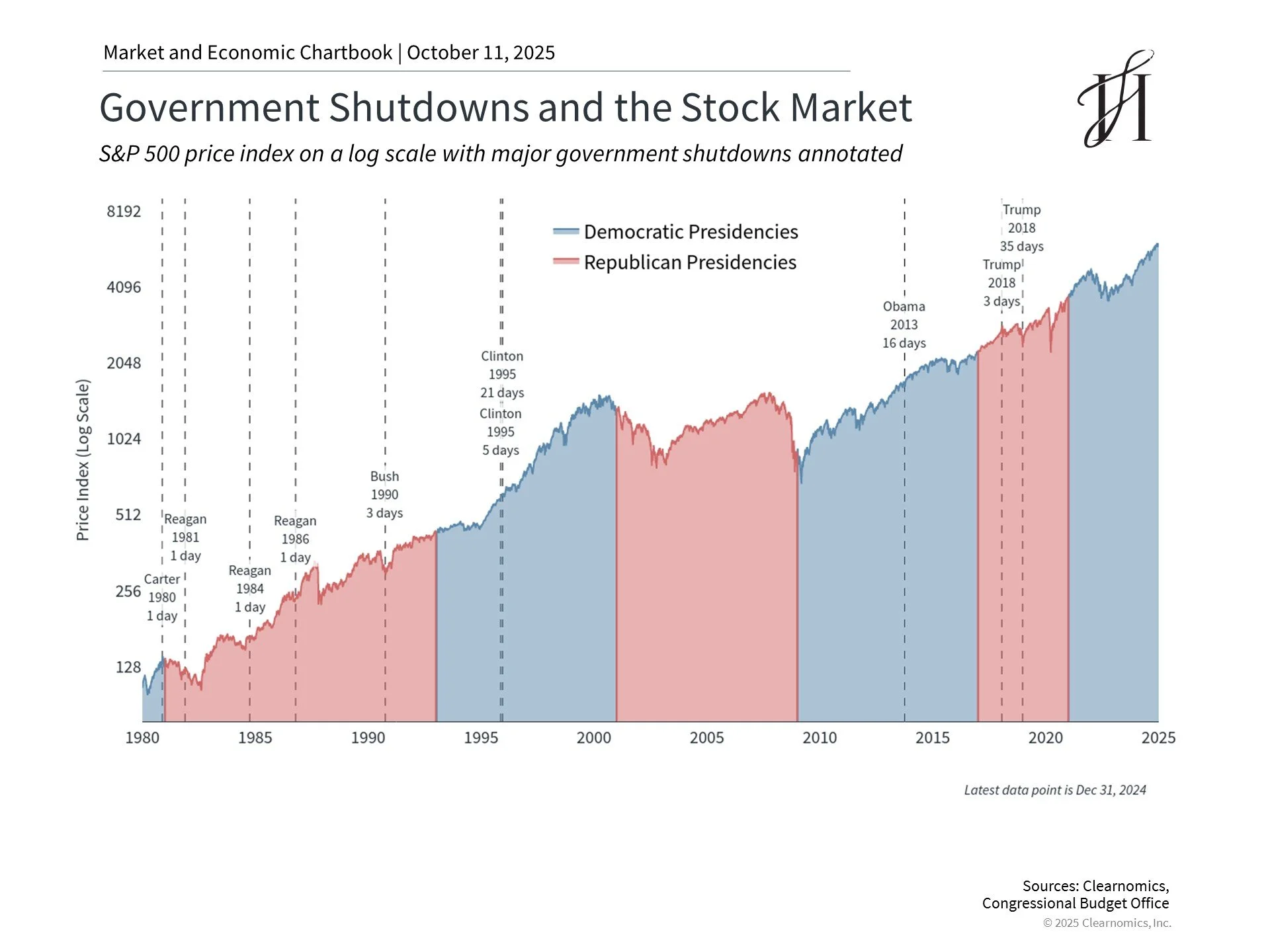

Government shutdowns aren’t new. They’ve happened under both parties and across multiple administrations, and each time, markets have largely stayed focused on the bigger picture.

Yes, some government operations pause, and federal workers are temporarily furloughed. But from an investment standpoint, shutdowns have historically had minimal long-term impact. In most cases, the market has continued to move along its existing trajectory, driven by fundamentals like earnings, inflation, and economic growth rather than short-term political disruptions.

What’s Different This Time

This year’s shutdown is unfolding against a backdrop of broader fiscal challenges. With federal debt now nearing 120% of GDP, the debate isn’t just about short-term spending bills, it’s about how we manage long-term fiscal responsibility and competing policy priorities like healthcare, trade, and immigration.

Credit rating agencies have flagged the mounting debt as a structural concern, but so far, financial markets have continued to take it in stride. The reason? Investors remain focused on real economic drivers such as job growth, corporate earnings, and consumer spending, all of which have remained resilient.

The Market’s Real Focus

Shutdowns can delay government reports (like employment or inflation data) and temporarily affect economic visibility, but these disruptions are generally short-lived. Markets tend to recalibrate quickly once data resumes and political noise subsides.

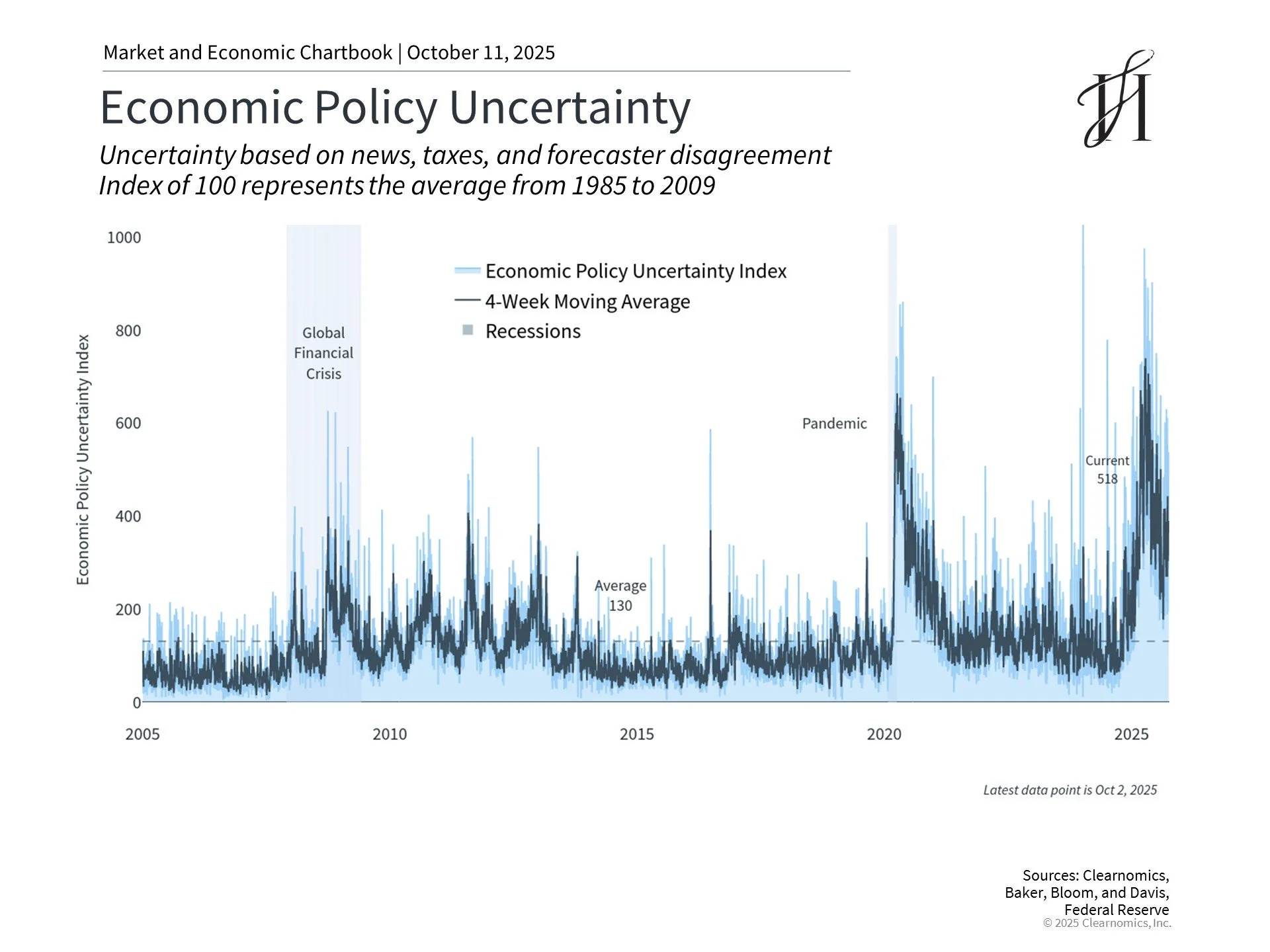

Historically, even multi-week shutdowns haven’t derailed long-term investment performance. The Economic Policy Uncertainty Index, which measures how much policy debate rattles markets, remains within normal ranges — a reminder that investors often look past the headlines and toward fundamentals.

The Economic Policy Uncertainty measure shown above indicates that recent policy clarity has helped reduce uncertainty toward historical averages. This pattern reinforces that markets adapt to political developments and maintain focus on longer-term economic drivers.

The Bottom Line

While the current shutdown creates very real challenges for federal employees and agencies, the broader market impact is typically limited.

For long-term investors, this is another reminder to stay grounded in your financial plan. Market fluctuations driven by political headlines tend to fade quickly, but disciplined strategies — diversified portfolios, regular rebalancing, and a focus on long-term goals — continue to compound over time.

If you’re wondering whether this changes your investment outlook or want to stress-test your plan in light of current events, now is a great time to revisit your portfolio strategy and confirm it’s aligned with your broader financial vision.

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC.

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.