Quarterly Market Update for Q4 2025: Navigating Conflicting Signals

We have experienced plenty of market swings this year, which is a normal part of investing, but not always a comfortable one. Between the tariff-driven selloffs earlier this year and the recent surge to new record highs, the ride has been anything but quiet.

For many, that volatility can stir up mixed emotions. When markets fall, it’s easy to feel uneasy, even though those moments often create opportunities to invest at more attractive valuations. And when markets rebound to record levels, that same uncertainty can resurface for different reasons: Can this pace really continue?

In both cases, the most successful investors aren’t those who react to the moment, but those who build portfolios designed to weather every phase of the market cycle, with eyes firmly on their long-term goals.

Entering Q4: A Market Full of Contradictions

As we begin the final quarter of 2025, investors are facing a blend of optimism and caution. The S&P 500 reached new all-time highs in the third quarter, supported by strong corporate earnings and continued enthusiasm around artificial intelligence.

At the same time, the labor market has clearly softened since summer, hiring has slowed, and job growth has been weaker than expected. Yet GDP growth remains solid, and inflation continues to trend lower, giving the Fed more flexibility.

In other words, we’re closing the year with strong market performance, but mixed economic signals.

Q3 Market Highlights

Despite the noise, the numbers tell a powerful story:

Equities surged. The S&P 500, Nasdaq, and Dow Jones rose 7.8%, 11.2%, and 5.2% respectively during Q3, with all three hitting record highs in September.

Bonds rebounded. The Bloomberg U.S. Aggregate Bond Index gained 2.0% for the quarter and is now up 6.1% year-to-date.

International markets strengthened. Developed international stocks rose 4.2%, and emerging markets jumped 10.1%.

Gold hit new highs, rallying 16% to $3,841 per ounce.

Bitcoin gained ground, ending the quarter up, though still below its August peak.

The Fed cut rates by 0.25%, bringing the target range to 4%–4.25%.

The bottom line: markets remain resilient, even as investors weigh what comes next.

Valuations Are Climbing — And Perspective Matters

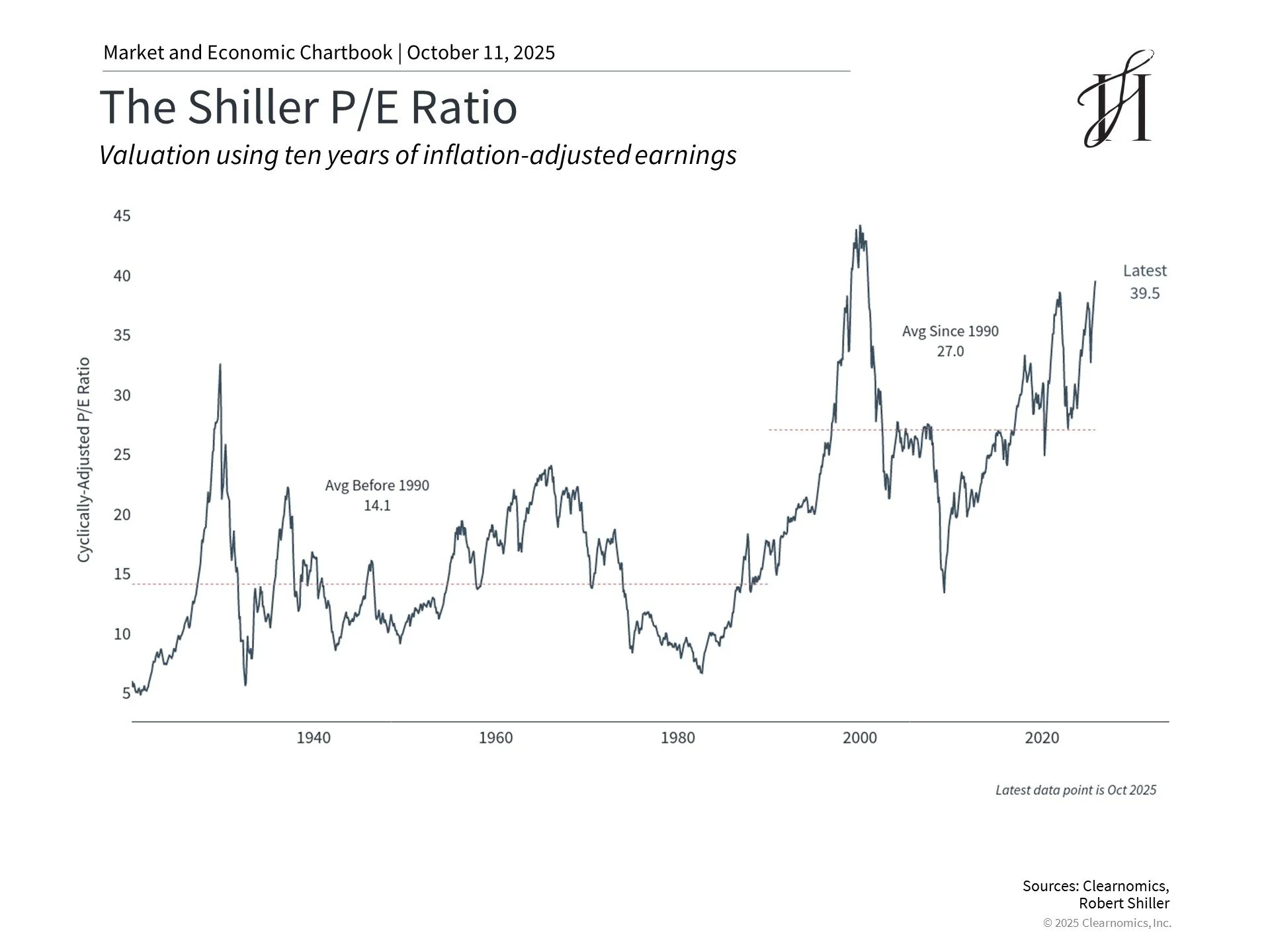

With the market at all-time highs, valuations have stretched. The S&P 500’s Shiller P/E ratio now sits around 38x, well above its 35-year average of 27x and nearing levels last seen during the dot-com era.

That doesn’t necessarily signal an imminent correction, but it does highlight the importance of balance. High valuations often reflect optimism and strong performance, but they also mean expectations are lofty.

Not all corners of the market are equally expensive. Small-cap, value, and international stocks remain relatively attractive compared to large-cap growth names. For investors willing to look beyond the usual suspects, there are still opportunities to build value thoughtfully and diversify risk.

The Fed’s Shift: Rate Cuts Begin

After holding steady for much of the year, the Fed cut rates by 0.25% in September — a move aimed at supporting a slowing labor market without derailing economic growth.

This easing cycle looks different from past ones. Historically, the Fed cuts rates during recessions. This time, it’s adjusting policy even as the economy remains strong, signaling an attempt to “normalize” after the aggressive tightening of 2022–2023.

With unemployment still low at 4.3% but job creation slowing sharply, the Fed is walking a fine line. Their latest statement notes that “downside risks to employment have risen,” suggesting more cuts may come if weakness continues. For investors, modest rate cuts tend to support both stocks and bonds when growth remains positive.

Volatility Has Calmed — For Now

After a bumpy start to the year driven by tariffs and tax headlines, volatility has settled. The VIX, a key measure of market fear, sits below its long-term average, and bond market volatility has also eased.

Still, calm markets can shift quickly. The ongoing government shutdown, tariff policies, and global trade discussions could easily spark short-term swings. But for long-term investors, volatility isn’t the enemy, it’s the environment where opportunity lives.

The Infinite Heights View

For women leaders and business owners, this kind of market backdrop underscores the importance of clarity and discipline. You can’t control the headlines, but you can control your plan.

That means keeping portfolios diversified, staying invested through cycles, and using volatility as a chance to rebalance strategically, not emotionally.

As we close out 2025, remember: market highs aren’t a signal to retreat, and market dips aren’t a sign to panic. They’re both reminders that successful investing is a marathon, not a sprint, one best run with purpose, patience, and perspective.

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC.

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.