Is Social Security Going Away? What You Really Need to Know

Social Security often feels like a mystery, especially when headlines warn that it’s “running out.” And while it is facing real funding challenges, that doesn’t mean it’s disappearing overnight. The real question isn’t “Will Social Security be there?” It’s “How should I plan, knowing things might change?”

Let’s walk through what’s happening and how to think about Social Security as only part of a broader, well-crafted financial plan.

A Quick History Lesson

Social Security was created in 1935 as a safety net during the Great Depression. Today, it provides income to over 70 million Americans-retirees, disabled workers, and their families. It’s funded through payroll taxes, meaning today’s workers pay into the system, and that money supports current retirees.

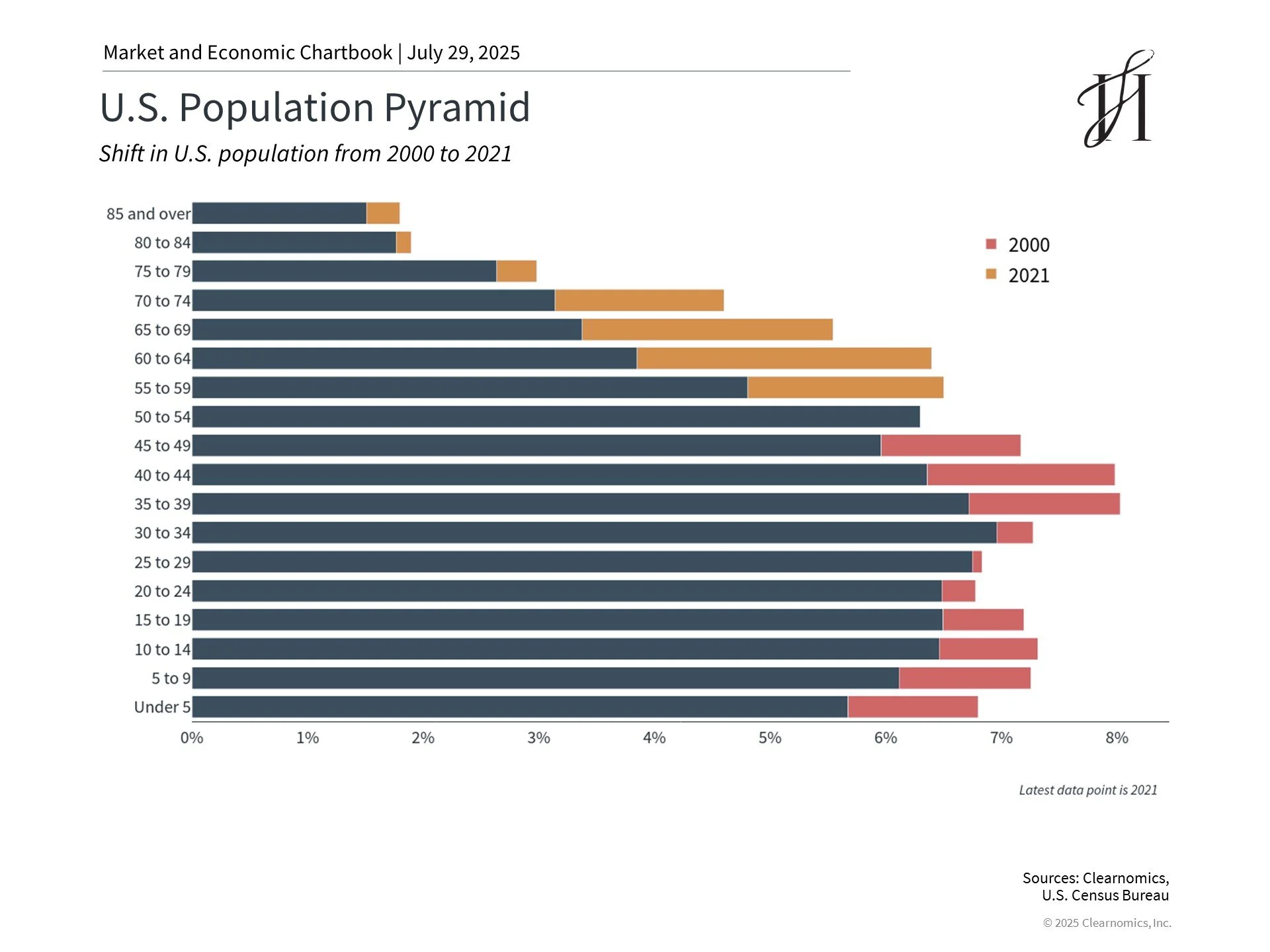

That worked well when there were 40+ workers for every retiree. But today? We’re down to fewer than 3. And as the population ages, that number will keep falling, especially with lower birth rates and people living longer.

The latest projections suggest that the Social Security trust fund will be depleted by 2034. If nothing changes, incoming taxes would still cover about 78% of promised benefits, but that means a cut for future recipients unless reforms happen.

Living longer is a blessing, but a challenge for the Social Security trust fund

Living longer is a gift but it’s also putting pressure on a system that wasn’t built for 30+ year retirements. At the same time, U.S. debt is nearing $37 trillion, and budget deficits make benefit cuts or tax increases more politically charged than ever.

Some proposed fixes include raising the retirement age, increasing the taxable wage base, or reducing benefits for high earners. Other countries have already implemented similar changes. We’re likely to see some form of reform, just probably not a sweeping overhaul anytime soon.

So how should you approach planning with all this in mind?

Smart Planning Starts Now

Whether retirement feels far away or right around the corner, Social Security should be part of your plan, but not the foundation of it. Here are key strategies we consider with clients:

1. Delay Strategically

You can claim benefits as early as 62, but that comes with a permanent reduction. Delaying until age 70 can boost your monthly benefit by about 8% per year. The breakeven age is generally early 80s, but we also look at opportunity cost, investment returns, and your overall income plan before deciding.

2. Use Bridge Strategies

If you want to delay benefits but need income in the meantime, we may use portfolio withdrawals or other income sources to "bridge" the gap. This is especially important for married couples, where the higher earner’s benefit can impact survivor income.

3. Be Tax-Aware

Up to 85% of your Social Security benefit can be taxable depending on your other income. Thoughtful withdrawal sequencing and Roth conversion strategies can help minimize this tax hit.

4. Don’t Rely on It

If you’re early in your career or business journey, assume Social Security will be part of your income in retirement, but not your main source. We plan around private savings, business assets, and other tax-advantaged vehicles first.

5. Stay Informed

Policy changes are coming, it’s just a matter of when. Working with an advisor who stays on top of legislation is key so you’re not caught off guard.

6. Maximize What You Can Control

Tax-advantaged accounts like 401(k)s, Roth IRAs, and HSAs are powerful tools that don’t rely on Congress to keep working. Prioritizing these accounts helps you build independence from whatever happens with Social Security.

Bottom Line

Social Security isn’t disappearing, but it is evolving. Rather than guessing what Congress will do, we help our clients build resilient, flexible plans that work under multiple future scenarios.

You deserve a retirement that’s not only secure, but aligned with your values and lifestyle. Social Security may be part of that picture, but the real power lies in the planning we do together.

If you're ready to revisit your retirement strategy or want help understanding how Social Security fits into your broader goals, let’s talk.

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC.

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.