Monthly Market Update for July 2025: Record Highs, Tariff Tensions, and What It Means for Your Plan

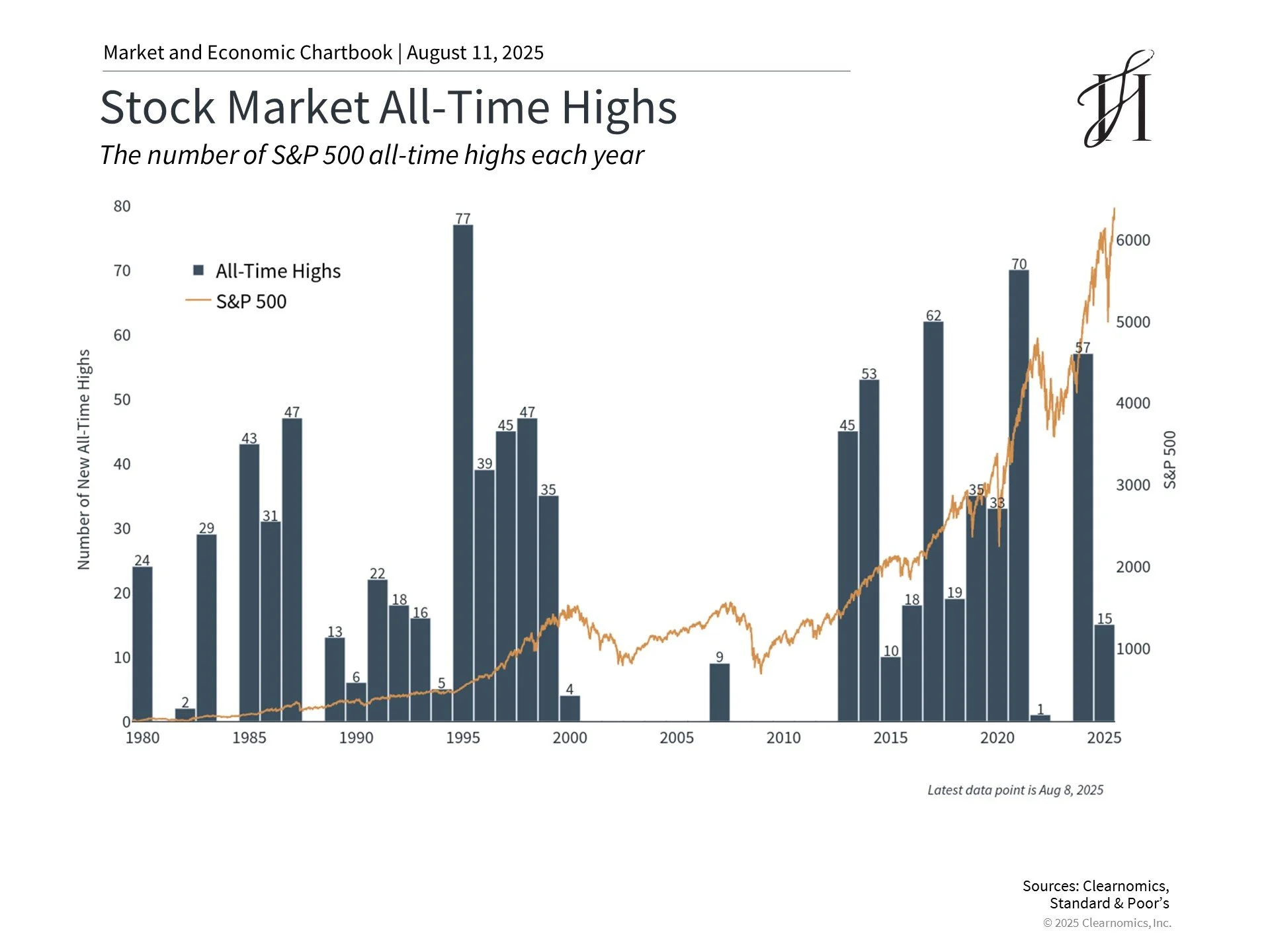

July delivered remarkable performance for equity markets, with the S&P 500 hitting ten new all-time highs, fueled by strong corporate earnings, steady economic growth, and trade deals wrapped up before new tariffs kicked in. In the second half of the month, the index posted six consecutive record-setting days, bringing its total gain for the year to 7.8%.

But as the month closed, the mood shifted. On July 31, a new tariff announcement raised concerns about potential price increases for consumers. At the same time, employment data showed the job market has cooled more than earlier reports suggested.

For long-term investors, these swings are a good reminder: conditions can change quickly, but your plan is designed to weather both the highs and the lows. Staying invested through the noise is still the best way to reach your goals.

Key Market and Economic Drivers

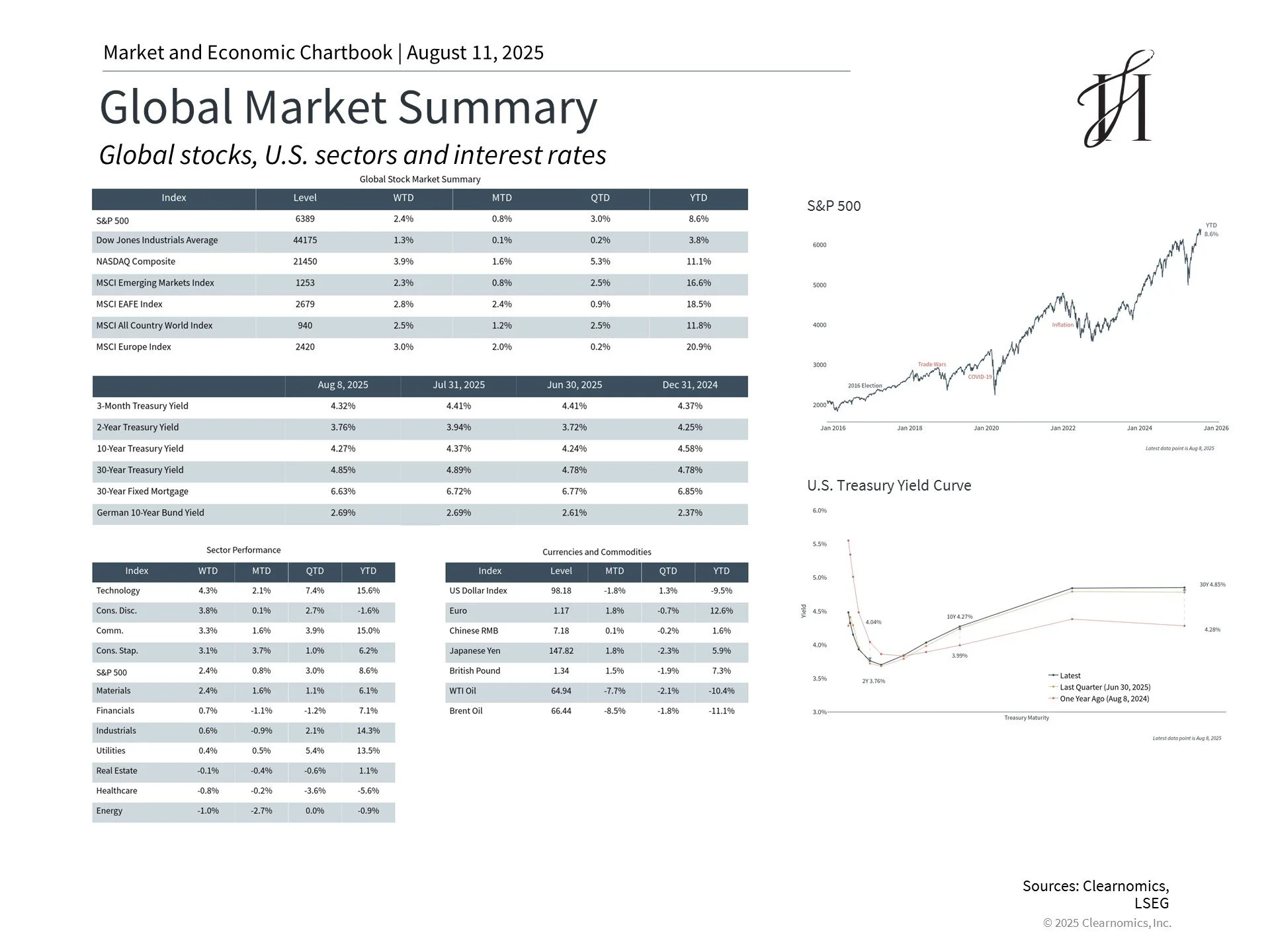

The S&P 500 gained 2.2% in July, the Dow Jones was up 0.1%, and the Nasdaq rose 3.7%. For the year, the S&P 500 is up 7.8%, the Dow is up 3.7%, and the Nasdaq is up 9.4%.

The main U.S. bond index fell 0.3% in July. The 10-year Treasury yield (interest rate) rose slightly to 4.38%.

International stocks were mixed. Developed market stocks fell 1.5% while emerging market stocks gained 1.7%.

The U.S. economy grew at a 3.0% annual rate in the second quarter, mainly due to business investment and import activity related to tariffs.

The U.S. dollar got stronger, rising from 96.88 to 99.97, but is still down for the year.

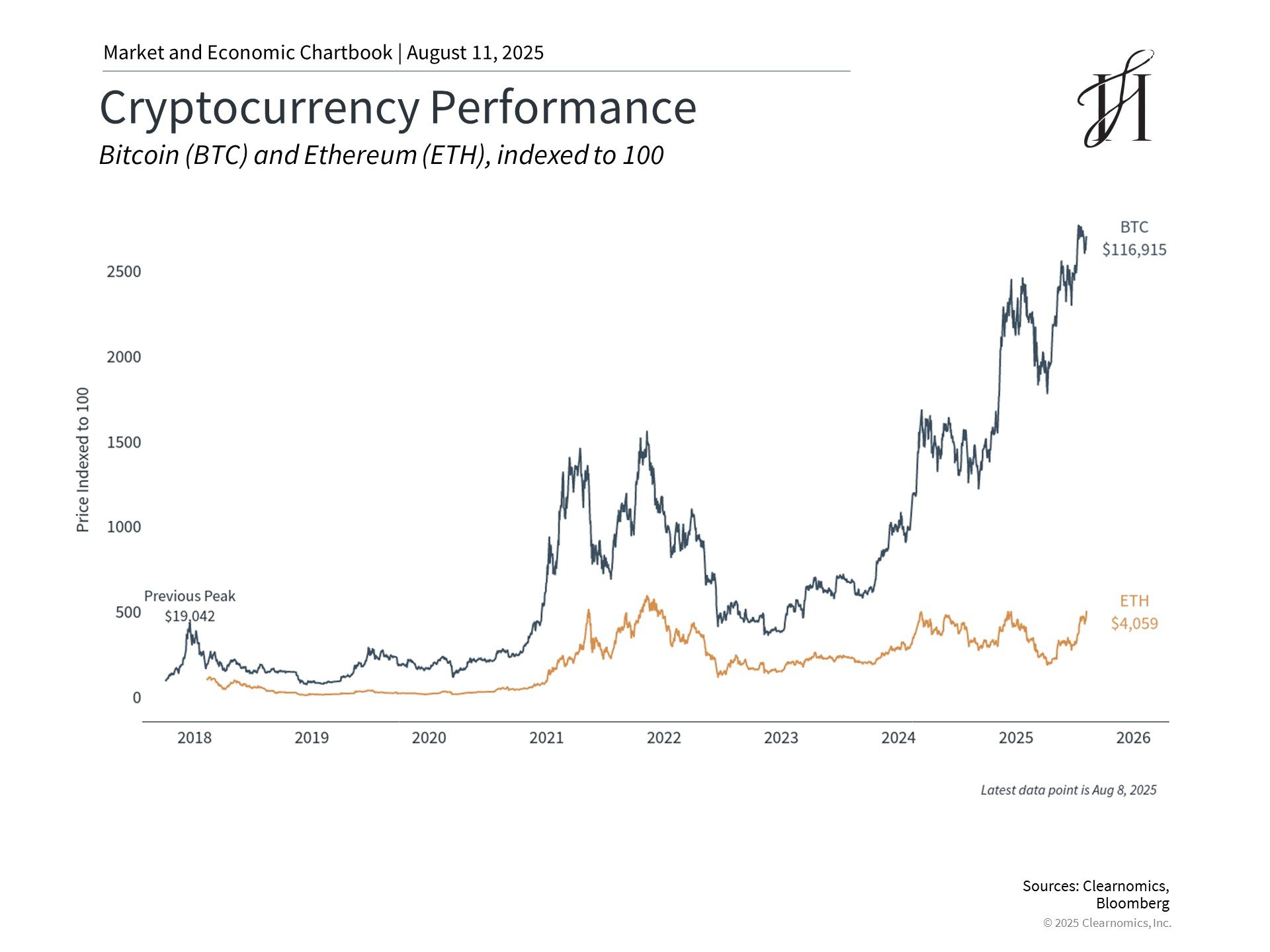

Bitcoin hit a record high of $120,198 mid-month before ending July at $116,491.

Gold prices stayed strong, ending the month at $3,293.

Copper hit record levels due to targeted tariffs, then dropped 22% in one day.

Consumer prices rose 2.7% compared to last year, matching what economists expected.

Only 73,000 jobs were added in July. Previous months were revised lower, showing the job market was weaker than first reported. The unemployment rate stayed low at 4.2%.

Markets Reach All-Time Highs

Companies reported strong earnings in July, which pushed stock prices higher. While many companies felt some impact from tariffs, the effects weren't consistently bad. Over 80% of S&P 500 companies that reported beat earnings expectations. Overall earnings growth is now 6.4% per year, which is lower than recent quarters but better than Wall Street expected.1

Excitement about artificial intelligence helped several Magnificent 7 stocks. Microsoft and Meta both reported better-than-expected earnings as they invested heavily in AI technology. Microsoft became only the second company ever to be worth over $4 trillion. However, Tesla disappointed investors with weak second-quarter results.

The Federal Reserve kept interest rates unchanged at 4.25% to 4.50% for the fifth meeting in a row. They're trying to balance inflation concerns from tariffs with economic growth. For the first time since 1993, two Fed officials voted against this decision, wanting to cut rates instead.

Investors Await New Trade Deal and Tariff Announcement

The White House announced several new trade deals in July with the European Union, Japan, and South Korea. Trade talks with China are still ongoing. These deals avoided the worst-case scenario many investors feared, but other countries still face potentially higher tariff rates. On July 31, President Trump announced new tariff rates set to begin August 7.

As of July 23, consumers face an overall tariff rate of 20.2%, the highest since 1911. So far, companies have absorbed much of this extra cost rather than passing it on to shoppers. Whether this continues depends on final tariff levels and how well companies adapt.

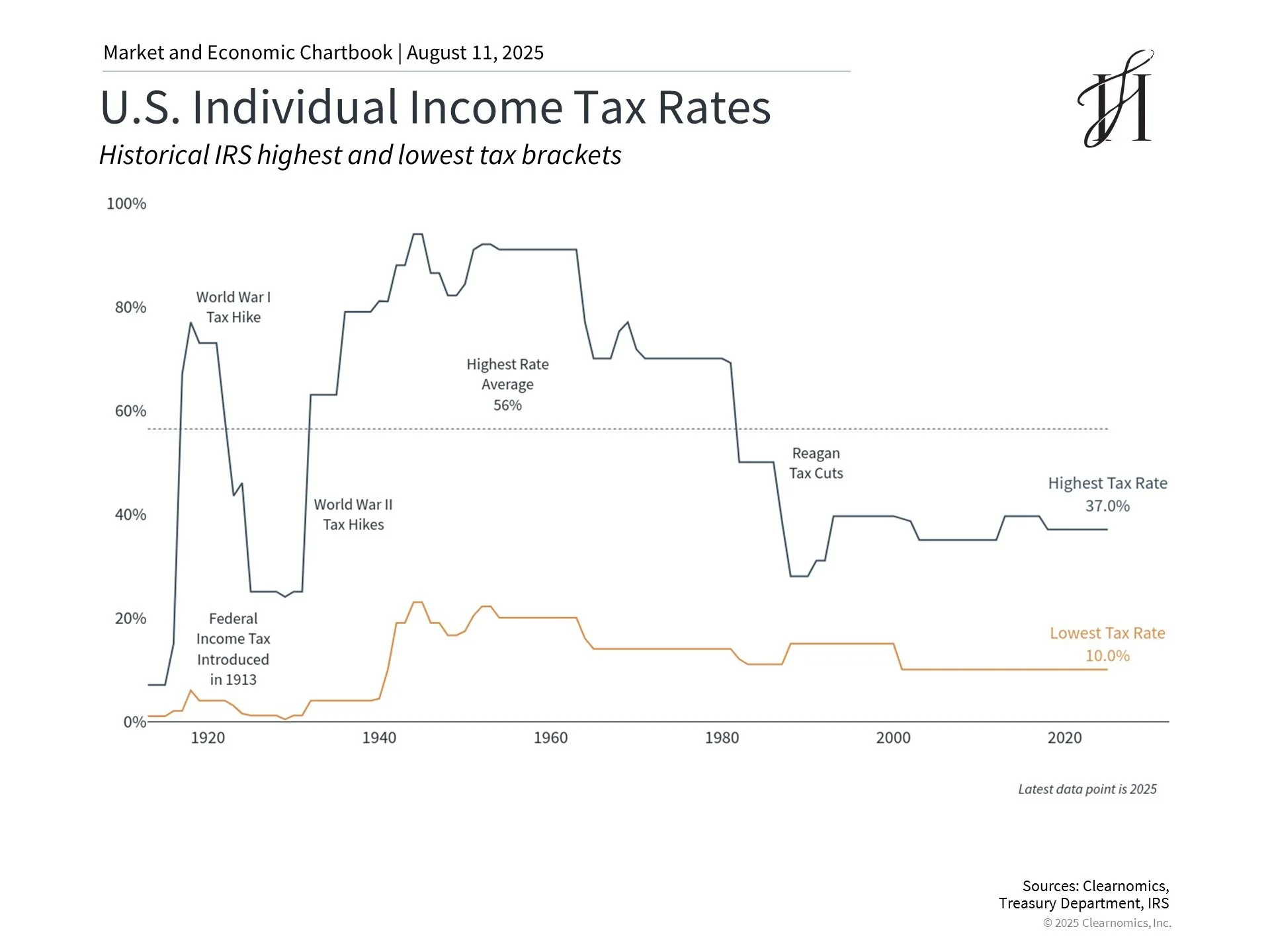

Congress Enacted Significant Tax Measures

President Trump signed comprehensive tax and spending legislation on July 4, making numerous Tax Cuts and Jobs Act provisions permanent, including existing tax rates and brackets. While the bill provides greater certainty by preserving the current low-tax framework, it also raises questions about the mounting national debt's sustainability.

The Congressional Budget Office projects the legislation will increase the national debt by more than $3 trillion over ten years. Although the bill included spending reductions for major programs, these were exceeded by tax revenue decreases.

Making these tax provisions permanent eliminates uncertainty that had complicated long-term financial planning, as many TCJA elements were set to expire this year. This clarity could support business investment and consumer spending in the immediate term.

New Laws on Cryptocurrency

Bitcoin achieved new peaks in July as lawmakers deliberated cryptocurrency regulation legislation. The administration's supportive stance toward broader cryptocurrency adoption has contributed to Bitcoin's 2025 gains. Additionally, the newly enacted GENIUS Act addresses stablecoin regulation, particularly those tied to the U.S. dollar.

What This Means for You

Markets established numerous records during a month characterized by tariff volatility, new tax legislation, and earnings reports. Looking ahead to August, trade developments and earnings results will likely continue capturing investor attention. July’s headlines reinforce the value of:

Staying invested through short-term volatility

Keeping an eye on tariff developments that could impact costs and consumer demand

Taking advantage of the stability in tax policy to make strategic long-term decisions

Reviewing your portfolio’s balance between growth opportunities (like tech and AI) and defensive positions (like bonds and dividend stocks)

The market’s record highs are encouraging, but your success isn’t tied to any single month, it’s built over years of disciplined, intentional decisions.

As always, contact us with any questions or if you would like to dive into our market outlook further!

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC.

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.