What Investors Can Be Grateful For This Holiday Season

The holiday season naturally invites reflection. At Infinite Heights, this is the time of year when many of my clients pause long enough to look back on everything they have built in their businesses, their lives, and their financial plans. It is easy to focus on the next goal or the next potential risk. It is much harder to stop and acknowledge the progress already made.

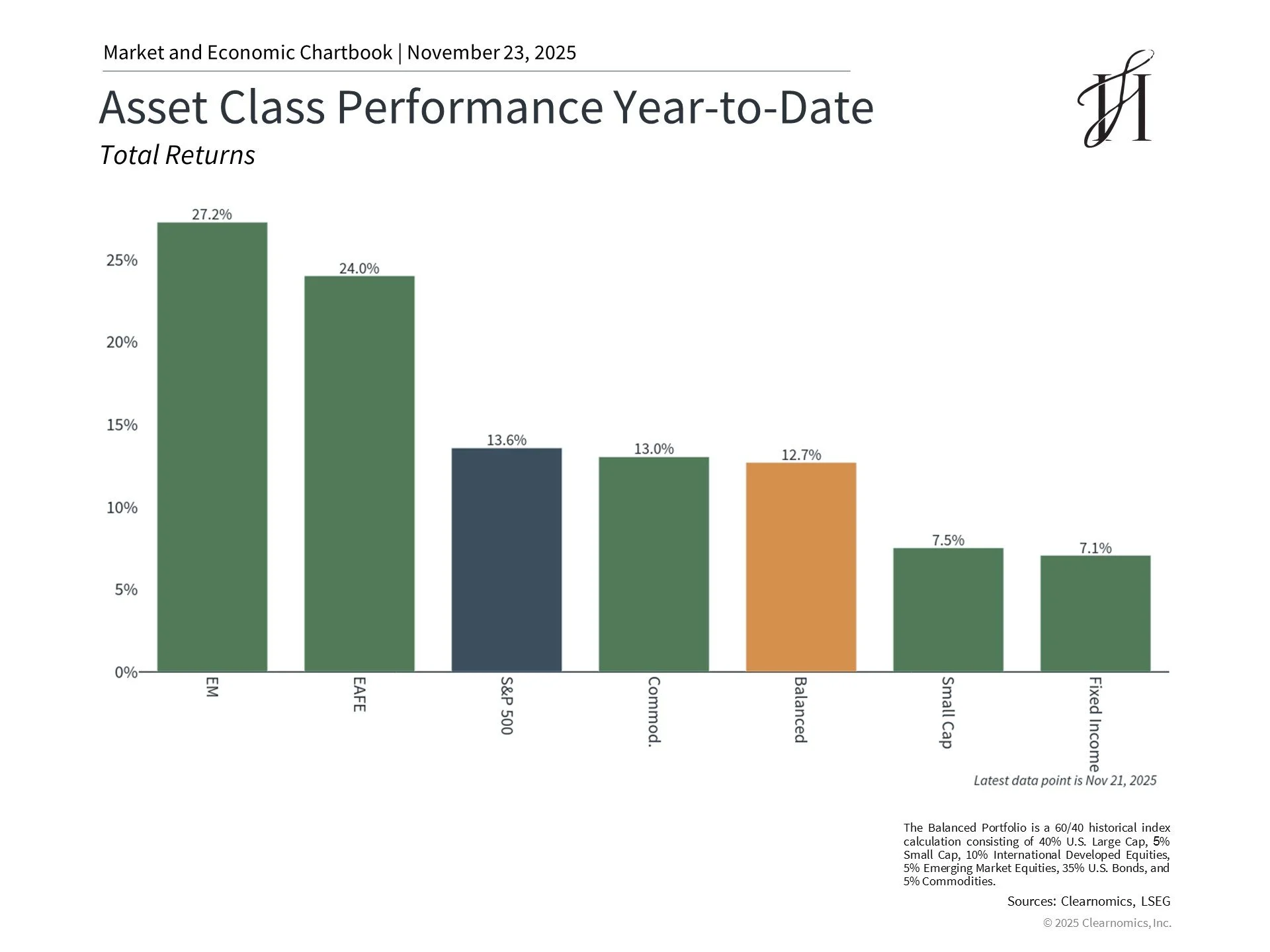

This year has given investors many reasons to be grateful. Markets have delivered strong performance across stocks and bonds, and diversified portfolios have been rewarded for staying the course. Before we look ahead to a new year of planning and possibility, it is worth stepping back and recognizing the strength that has carried us here.

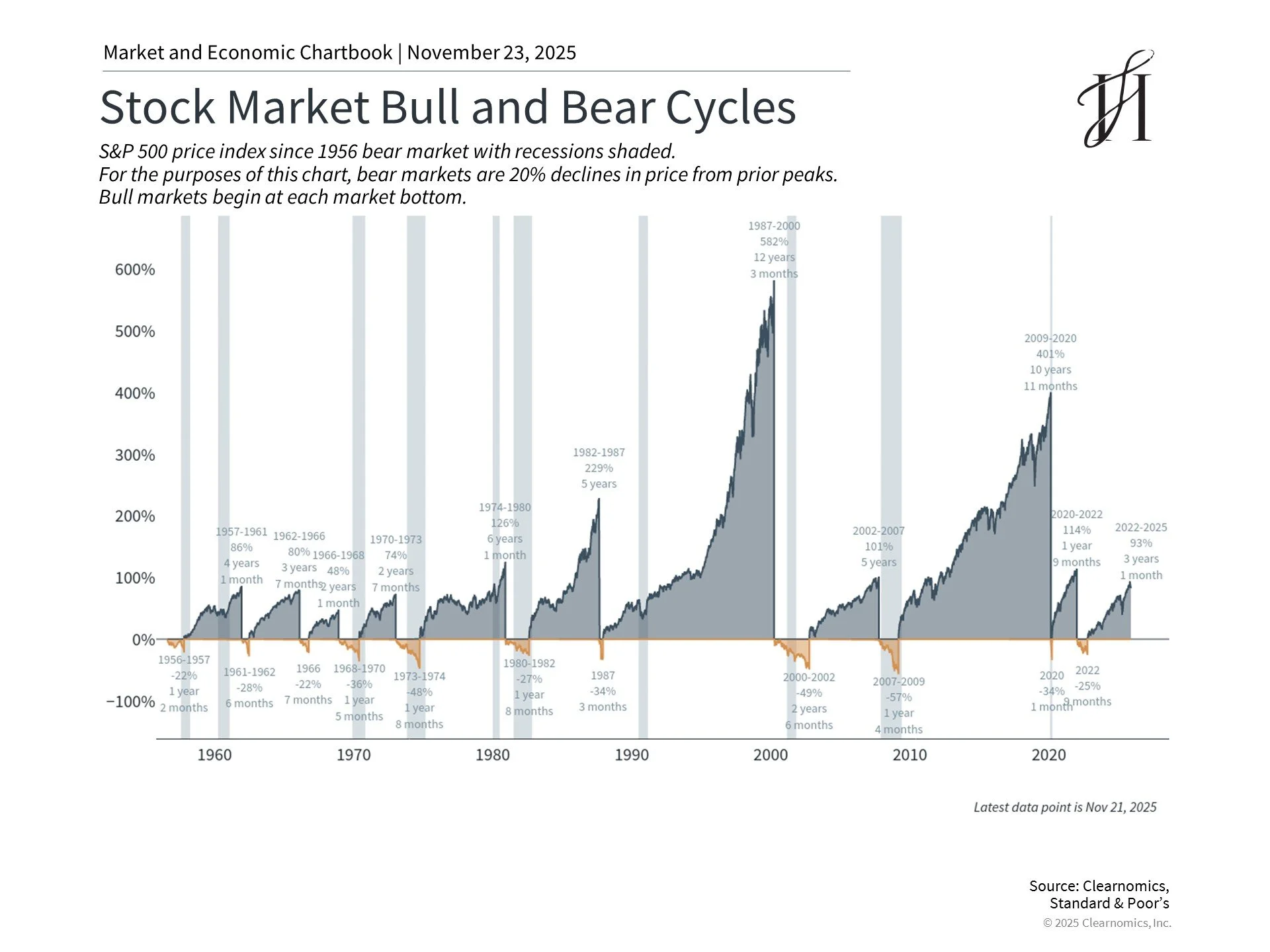

The bull market is now in its fourth year

The market rally that began after the October 2022 low has continued through 2025. The S&P 500 is up more than 15% year to date including dividends. Bonds, after several difficult years, have delivered positive returns as interest rates have stabilized. For the first time in several years, international stocks have outpaced domestic equities.

In other words, discipline has paid off.

Bull markets historically last much longer than bear markets. Many run five to ten years or more. And even though no two cycles are the same, the common thread is that long-term investors succeed by staying invested through a variety of environments.

The lesson remains the same. You do not need to predict the next headline. You need a strategy that keeps you positioned for long-term growth and protects you from emotional decision making.

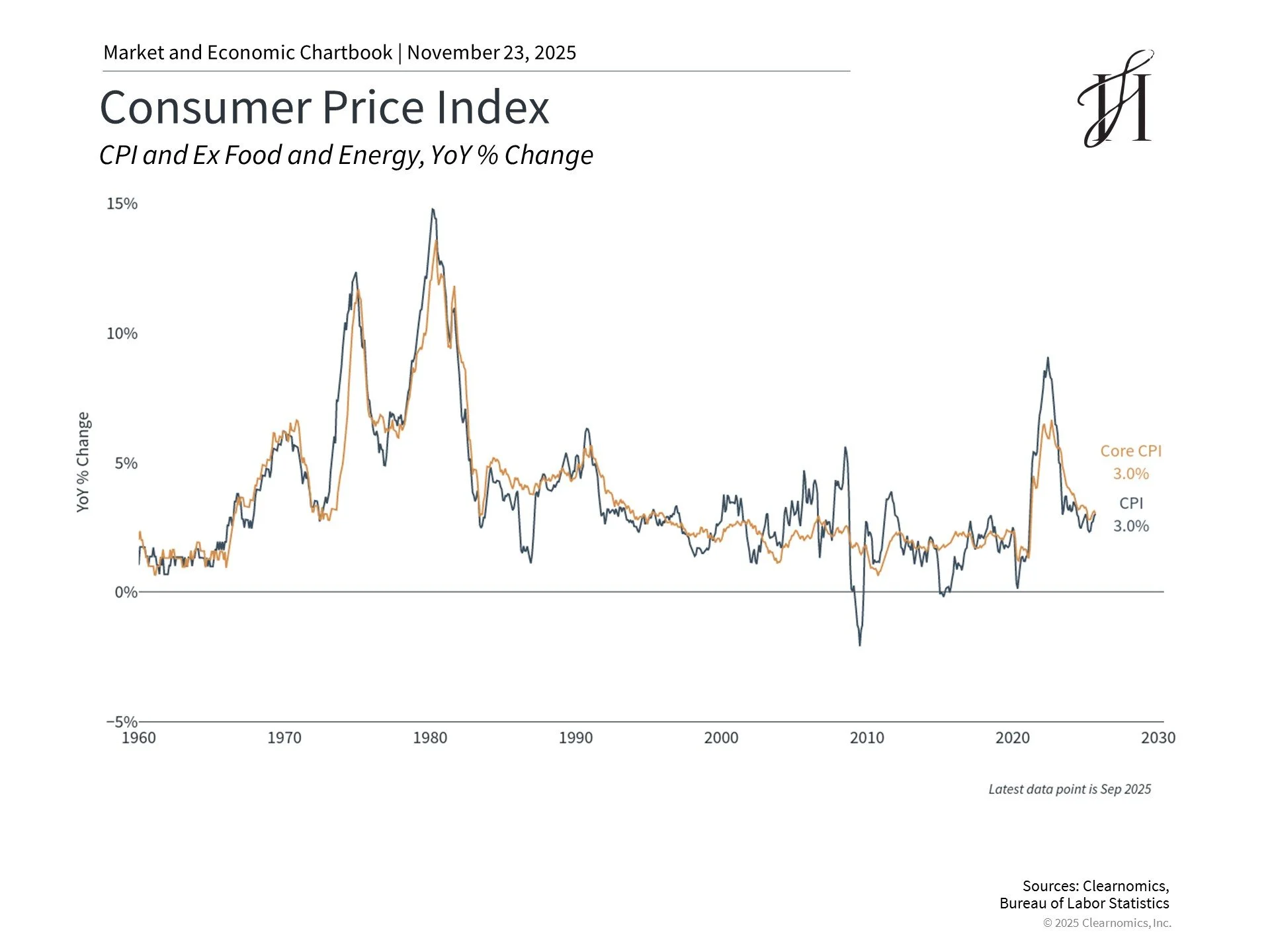

Inflation is moderating and the Federal Reserve has begun cutting rates

Inflation has not disappeared, but it has become far more predictable. It is now running near 3% annually, a shift that has allowed the Federal Reserve to begin reducing rates.

Lower interest rates often support both stocks and bonds because corporations face lower borrowing costs and existing bonds with higher yields become more attractive. They can also create breathing room for families and business owners who have felt the impact of elevated rates over the past two years.

This is not a signal that all challenges are behind us. It simply means the environment is becoming more balanced, which is good news for long-term investors and for anyone planning major financial decisions in the coming years.

Proper asset allocation still matters more than anything else

Periods of strong performance can create a sense of ease, yet risk management remains just as important. The S&P 500's price-to-earnings ratio stands at 22.6x, exceeding historical averages and gradually approaching levels last seen during the dot-com era. This does not suggest an imminent downturn, but it does reinforce the value of spreading risk across asset classes, sectors, and geographies.

A thoughtfully built portfolio allows you to stay invested without letting any single theme or headline dominate your outcomes. This becomes even more important as we enter a year filled with questions around artificial intelligence, geopolitics, tariffs, and the national debt. None of these topics should drive a reactionary move in your portfolio. Your planning should do the driving.

The bottom line

This is an ideal moment to pause and appreciate how far you have come. Markets have rewarded patience. Inflation has moderated. Interest rates are beginning to ease. Diversification has worked exactly the way it is designed to.

As you look ahead to a new year, the most powerful decision you can make is to stay anchored in a plan that reflects your life, your goals, and the future you are building. A well-designed portfolio does not chase headlines. It harmonizes risk and opportunity so that your wealth can support you in the seasons ahead.

If you would like to review your portfolio, talk through strategy, or explore how to align your financial plan with your next chapter, I am here.

All investing involves risk including loss of principal. No strategy assures success or protects against loss. All indices are unmanaged and may not be invested into directly. Asset allocation does not ensure a profit or protect against a loss.

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC.

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.