Venezuela: What’s Happening and What You Should Know

The recent detention of Venezuelan President Nicolás Maduro by U.S. authorities is a significant and unexpected geopolitical development. Reports indicate U.S. military forces carried out the operation based on long-standing allegations tied to narcotics trafficking and corruption. During a press briefing, President Trump also signaled that the United States intends to oversee Venezuela and support growth in its oil sector.

Naturally, much of the global focus is on humanitarian impact, regional stability, and political implications. But it is reasonable for you to wonder whether this may also affect markets and long-term portfolios. Questions around U.S. involvement, Venezuela’s future political direction, energy supply, and how other global powers might respond are all on the table.

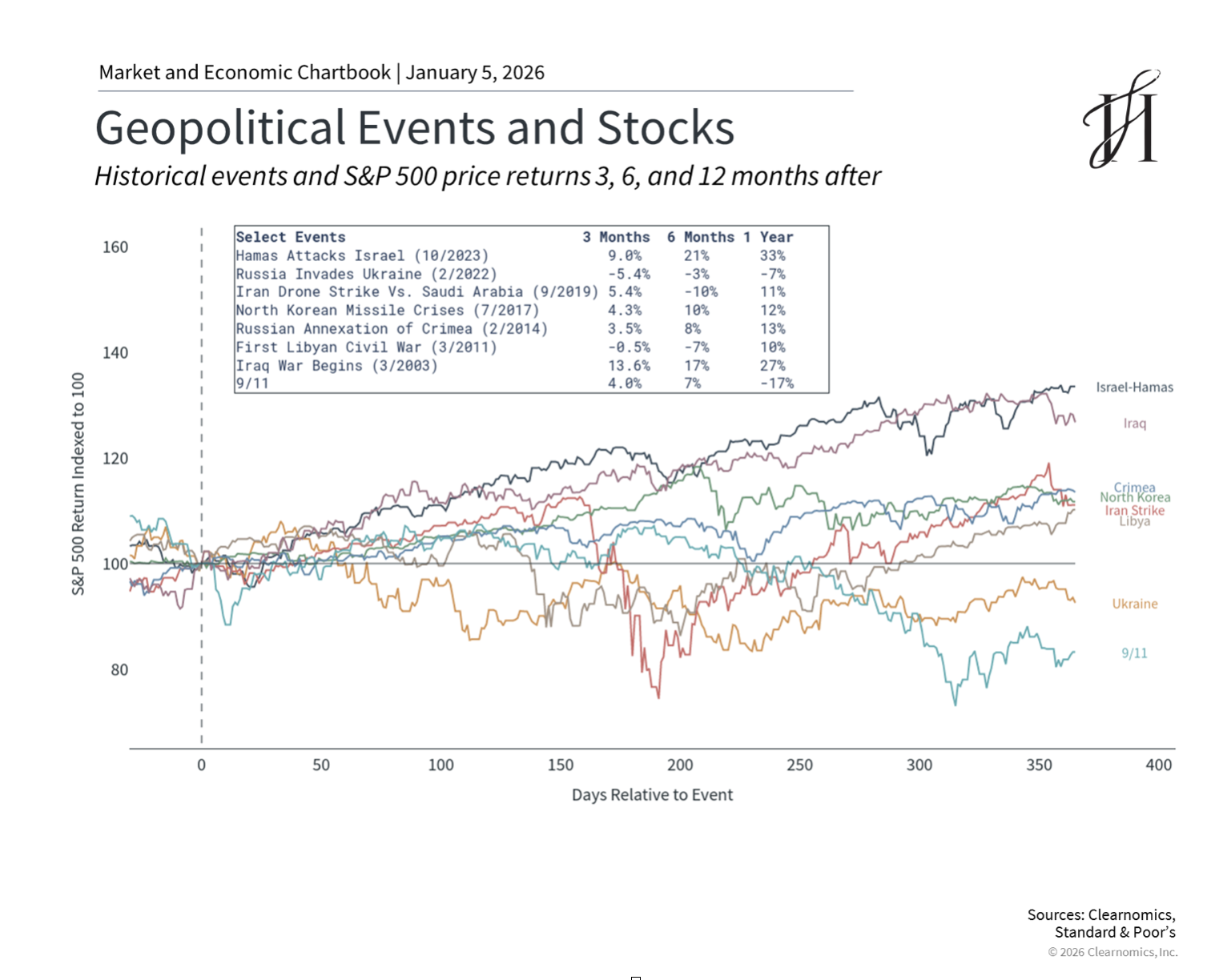

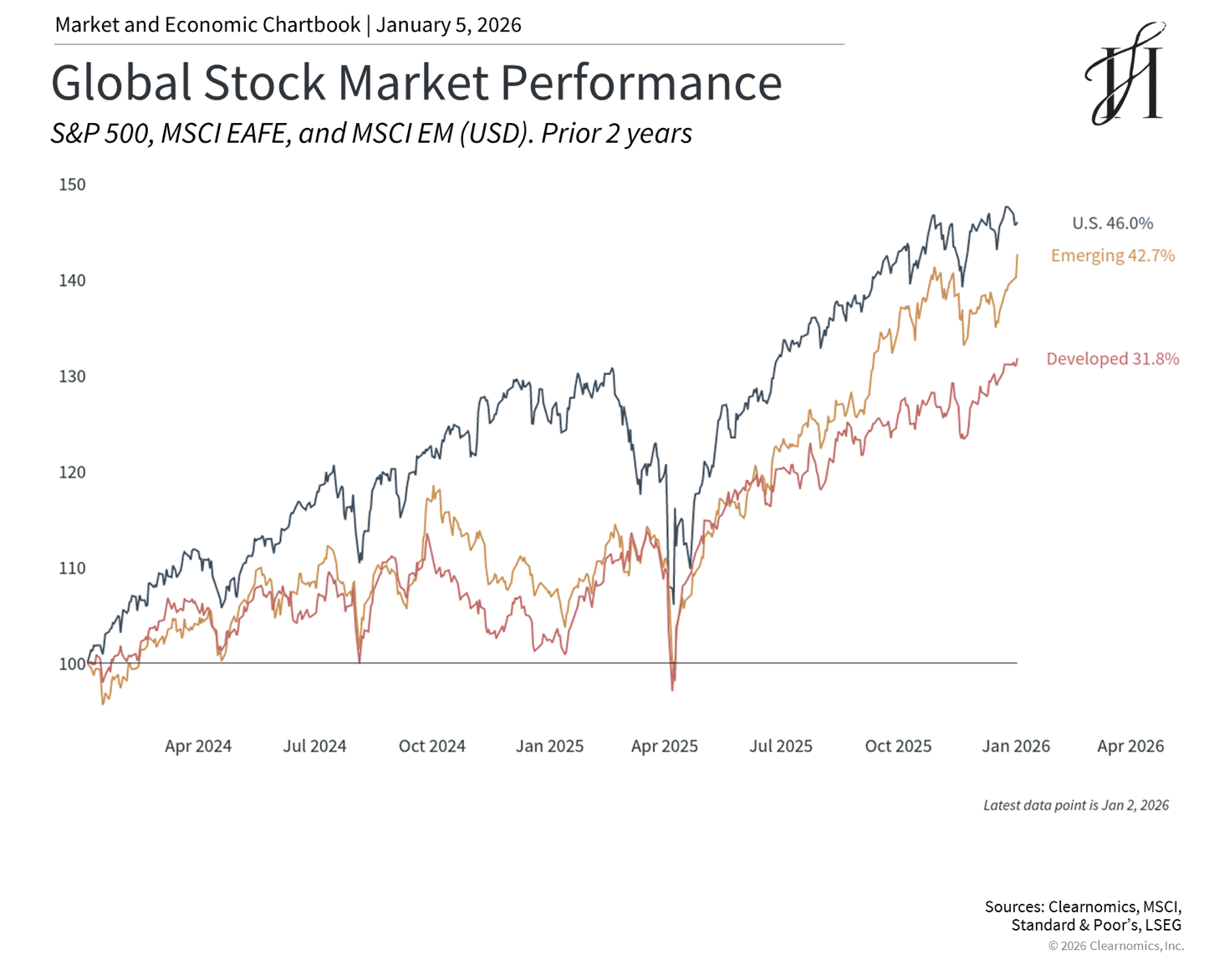

History gives us important perspective. Geopolitical shocks often generate short-term volatility, but they rarely change the core direction of markets over the long run. Even when energy prices are involved, markets typically adjust, stabilize, and resume following broader economic fundamentals. We have seen this repeatedly, including throughout conflicts involving Ukraine and the Middle East in recent years. Keeping that perspective helps us stay grounded rather than reacting emotionally to headlines.

Understanding the historical backdrop helps create clarity. The United States has had a long history of involvement in Latin America, dating back to the Monroe Doctrine in 1823, which asserted U.S. influence in the Western Hemisphere. That influence is resurfacing again today.

This is far from the first time the U.S. has intervened in a Latin American country. For example, in 1990, exactly 36 years ago to the day, the U.S. captured Manuel Noriega in Panama based on drug trafficking charges. And while the latest operation in Venezuela was generally unexpected, Maduro has been under indictment by the U.S. Department of Justice since 2020 on charges of narco-terrorism and drug trafficking. The Biden administration had maintained sanctions on Venezuela and, in early 2025, placed a $25 million bounty on Maduro, which was then raised to $50 million by the Trump administration.

Like other U.S. military and law enforcement actions, there are many interrelated objectives. The stated reason for the operation was to target narco-terrorism, which Maduro and 14 Venezuelan officials were criminally charged with by the U.S. in 2020. The fact that many nations view Maduro’s rule as illegitimate, based on the country’s 2024 election, strengthens this objective. Prior to the presidencies of Maduro and Hugo Chávez, Venezuela was a democracy and one of the wealthiest in the region.

For you, this is a reminder that while headlines can feel alarming, geopolitical risk is a normal part of investing, even if the specific circumstances differ each time. These news stories may also feel more concerning since they differ from everyday business news about corporate earnings and economic data. The chart above highlights many significant geopolitical events over the past few decades. In most cases, markets recovered within weeks or months, if they were affected at all.

The Most Direct Link to Your Financial Life: Oil

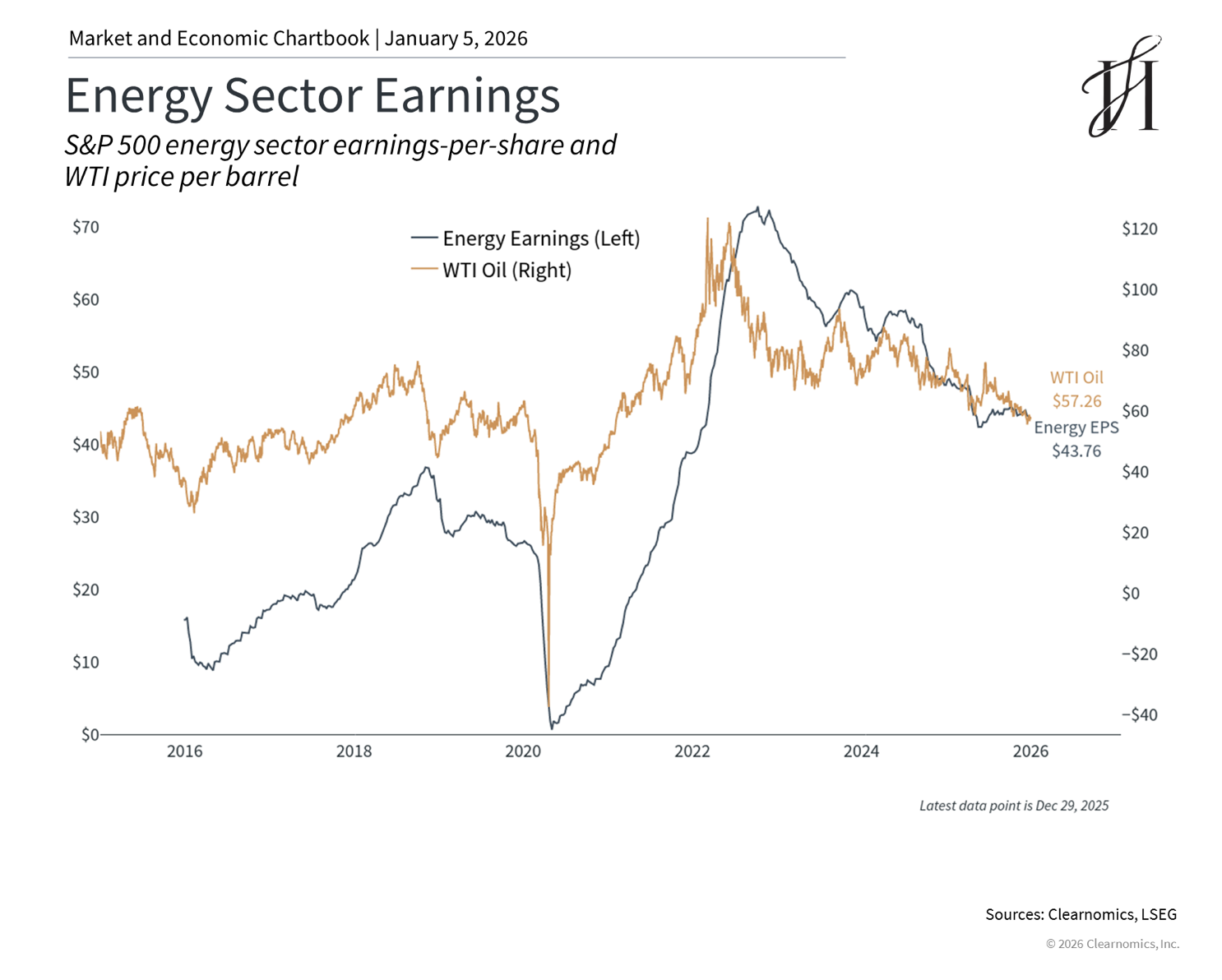

From an investment perspective, the most meaningful connection to watch is oil.

Venezuela holds the world’s largest known oil reserves, but production today is far below potential due to decades of mismanagement, lack of investment, and sanctions. Even if this situation eventually leads to higher production, it would take time, major capital investment, and meaningful stabilization. Any impact on global oil supply would likely unfold gradually, not overnight.

Oil prices are also well below the extreme levels we saw after Russia’s invasion of Ukraine, and the U.S. is now the world’s largest producer of oil and natural gas, which provides additional stability.

Could prices still move? Of course. Energy markets are unpredictable. But history shows that even when shocks happen, prices often stabilize sooner than many expect.

How Much Direct Exposure Do You Really Have?

The reality is that Venezuela plays a very small role in global financial markets today.

Its stock market is extremely limited and not part of major emerging-market indices, meaning most people do not have direct exposure in their portfolios. Venezuelan bonds have also been in default since 2017 and continue to trade under distressed conditions.

So instead of being a direct financial threat, Venezuela’s influence is more likely to come indirectly through energy markets and broader uncertainty — not through its own financial system.

The Bottom Line?

This is a meaningful geopolitical story with real humanitarian and political implications, and it is understandable if it raises questions. History reminds us, though, that well-built financial strategies are designed to navigate uncertainty. This situation will continue to develop, and headlines will continue — but trying to predict every twist or reacting impulsively rarely leads to better financial outcomes.

Moments like this can feel unsettling, but you do not have to navigate them alone. If you would like to talk through what this news may mean for your financial plan, or simply want a second set of eyes on your portfolio, we are here. Let’s connect and make sure you are positioned thoughtfully for what comes next.

References 1. https://www.eia.gov/outlooks/steo/tables/pdf/3dtab.pdf

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC.

Copyright (c) 2026 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.